Table of Contents

ToggleTypes of Government Subsidies for EVs

- Government subsidies for electric vehicles (EVs) are designed to encourage the adoption of cleaner transportation and reduce greenhouse gas emissions.

- These subsidies can take various forms, including tax credits, rebates, grants, and incentives.

- Here are some common types of subsidies and their impacts:

- Tax Credits:

- Federal Tax Credits: Many countries offer federal tax credits for purchasing EVs. For example, in the United States, buyers of qualified EVs can receive a tax credit of up to $7,500.

- State/Provincial Tax Credits: Additional credits may be available at the state or provincial level, further reducing the cost of EVs.

- Rebates:

- Point-of-Sale Rebates: Some regions offer direct rebates at the point of sale, lowering the upfront cost of purchasing an EV.

- Post-Purchase Rebates: Buyers may also be eligible for rebates after purchasing an EV, reimbursing a portion of the purchase price.

- Grants and Incentives:

- Charging Infrastructure Grants: Governments may provide grants for the installation of home or public charging stations, making it easier for consumers to charge their EVs.

- Fleet Grants: Businesses and organizations may receive grants to convert their vehicle fleets to electric, promoting large-scale adoption.

- Reduced Registration Fees: Some governments reduce or waive vehicle registration fees for EVs, lowering the overall cost of ownership.

- Access to HOV Lanes: In some areas, EV owners can use high-occupancy vehicle (HOV) lanes, even with a single occupant, saving time on commutes.

- Reduced Import Duties: Import duties on EVs may be reduced or eliminated, making imported EVs more affordable.

Impacts of Government Subsidies

- Increased EV Adoption: Subsidies lower the initial cost barrier, making EVs more accessible to a broader range of consumers.

- Environmental Benefits: Higher EV adoption rates can lead to significant reductions in greenhouse gas emissions and air pollution.

- Economic Growth: The EV industry can stimulate economic growth by creating jobs in manufacturing, sales, and infrastructure development.

- Technological Advancements: Increased demand for EVs drives innovation in battery technology, charging infrastructure, and vehicle design.

- Energy Security: Reducing dependence on fossil fuels enhances energy security by diversifying the energy mix.

Examples of Subsidy Programs by Country

- United States: The federal government offers tax credits up to $7,500, with additional incentives available at the state level. Some states like California offer rebates and grants for charging infrastructure.

- Canada: The federal government provides incentives up to CAD 5,000 for EV purchases, with additional provincial incentives in places like Quebec and British Columbia.

- Germany: The “Umweltbonus” program offers incentives up to €9,000 for EVs, shared between the federal government and manufacturers.

- China: The government offers substantial subsidies for EV purchases and invests heavily in charging infrastructure.

- India: The FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) scheme offers incentives for EV purchases and infrastructure development.

Challenges and Considerations

- Budget Constraints: Governments need to balance subsidy programs with budgetary constraints and other fiscal priorities.

- Market Distortion: Subsidies may lead to market distortions, with some consumers choosing EVs primarily for financial benefits rather than environmental considerations.

- Long-Term Sustainability: Subsidy programs need to be designed to transition towards a self-sustaining EV market without long-term reliance on government support.

Government subsidies for electric vehicles (EVs) in India

- Government subsidies for electric vehicles (EVs) in India are part of a broader strategy to promote cleaner transportation, reduce air pollution, and decrease dependency on fossil fuels.

- The Indian government has introduced several initiatives and programs to encourage the adoption of EVs. H

- here are the key subsidies and incentives available in India:

FAME India Scheme

- The FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) India scheme is the primary program supporting EV adoption in India.

- It has been implemented in phases:

FAME I

- Duration: Launched in 2015 and extended until March 2019.

- Focus: Provided incentives for the purchase of electric and hybrid vehicles, including two-wheelers, three-wheelers, four-wheelers, and buses.

- Subsidies: Offered subsidies up to INR 1.38 lakh for electric cars and INR 29,000 for electric two-wheelers.

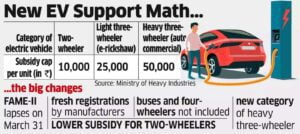

FAME II

- Duration: Launched in April 2019, extended until March 2024.

- Budget: Allocated INR 10,000 crore.

- Focus: Emphasizes public transportation, including electric buses, three-wheelers, and four-wheelers used for commercial purposes. Also supports private electric two-wheelers.

- Subsidies:

- Electric Two-Wheelers: INR 15,000 per kWh of battery capacity, with a cap of 40% of the vehicle cost.

- Electric Cars (commercial use): Up to INR 1.5 lakh.

- Electric Buses and Three-Wheelers: Varies based on vehicle specifications and usage.

- The system requires a minimum range of 80 kilometers and a top speed of 40 kilometers per hour for battery-powered two-wheelers.

- The FAME II e vehicle subsidy scheme is available for electric two-wheelers that cost less than Rs. 1.5 lakhs.

State-Level Incentives to EV

- Several Indian states offer additional subsidies and incentives to promote EV adoption:

-

Top EV-friendly States that Offer Best Incentives to Buyers

Delhi

- Subsidies: Up to INR 1.5 lakh for electric cars, INR 30,000 for electric two-wheelers, and INR 30,000 for e-rickshaws.

- Additional Benefits: Waiver of road tax and registration fees.

Maharashtra

- Subsidies: Up to INR 1 lakh for electric cars and INR 25,000 for electric two-wheelers.

- Additional Benefits: Waiver of road tax and registration fees, incentives for setting up charging infrastructure.

- Two-wheeler: Maximum up to Rs. 25,000

- Three-wheeler: Benefits up to Rs. 30,000

- Four-wheeler: Maximum up to Rs. 2.5 lakh

Karnataka

- Subsidies: Incentives for electric two-wheelers, three-wheelers, and commercial vehicles.

- Additional Benefits: Waiver of road tax and registration fees.

Tamil Nadu

- Subsidies: Incentives for electric two-wheelers, three-wheelers, and commercial vehicles.

- Additional Benefits: Waiver of road tax and registration fees, incentives for EV manufacturing and charging infrastructure.

- Tamil Nadu offers a 100% road tax waiver and zero registration charges for EV buyers. However, the state government is looking to reconsider its EV policy

Telangana

- Subsidies: Incentives for electric two-wheelers, three-wheelers, and commercial vehicles.

- Additional Benefits: Waiver of road tax and registration fees, incentives for EV manufacturing and charging infrastructure.

Gujarat

- Two-wheeler: Maximum up to Rs. 20,000

- Three-wheeler: Benefits up to Rs. 50,000

- Four-wheeler: Maximum up to Rs. 1.5 lakh

Kerala

- EV buyers in Kerala can get a 50% discount on road tax for the first five years.

- The state also gives a subsidy to e-rickshaws ranging from 10,000 to 30,000.

Meghalaya

- Two-wheeler: Maximum up to Rs. 20,000

- Three-wheeler: NA

- Four-wheeler: Maximum up to Rs. 60,000

Charging Infrastructure Incentives

- Government Support: Financial assistance for setting up charging stations under FAME II.

- Private Sector Participation: Encouragement of private sector investment in charging infrastructure through subsidies and grants.

GST Reduction

- GST Rate: Reduced GST rate of 5% on electric vehicles compared to the standard rate of 28% on internal combustion engine vehicles.

Income Tax Benefits

- Tax Deduction: Under Section 80EEB of the Income Tax Act, individuals can claim a deduction of up to INR 1.5 lakh on the interest paid on loans taken for purchasing electric vehicles.

Import Duty Reduction

- Reduced Import Duty: The government has proposed reducing import duties on certain EV components to promote local manufacturing and reduce costs.

Impact of Subsidies

- Increased EV Adoption: Subsidies significantly lower the upfront cost of EVs, making them more attractive to consumers.

- Environmental Benefits: Higher adoption rates of EVs contribute to reduced air pollution and greenhouse gas emissions.

- Economic Growth: Encourages investment in the EV sector, creating jobs and promoting technological advancements.

- Energy Security: Reduces reliance on imported fossil fuels, enhancing energy security.

Challenges

- Awareness and Education: Need for increased consumer awareness about the benefits and availability of subsidies.

- Infrastructure Development: Expansion of charging infrastructure is crucial to support the growing number of EVs.

- Long-Term Sustainability: Ensuring that subsidies and incentives are part of a sustainable strategy for long-term EV adoption.

By leveraging these subsidies and incentives, India aims to accelerate the transition to electric mobility, contributing to environmental sustainability and energy security.

Conclusion

- By carefully designing and implementing subsidy programs, governments can effectively promote the adoption of electric vehicles and accelerate the transition to a more sustainable transportation system.

- Government subsidies for electric vehicles (EVs) play a crucial role in promoting the adoption of cleaner transportation options, reducing greenhouse gas emissions, and supporting the growth of the EV industry. Here are some common types of government subsidies for EVs and their impacts:

Post Views: 185